All Categories

Featured

In 2020, an approximated 13.6 million united state families are certified investors. These families control huge wealth, approximated at over $73 trillion, which represents over 76% of all personal wealth in the U.S. These investors participate in financial investment possibilities normally inaccessible to non-accredited investors, such as investments secretive companies and offerings by certain hedge funds, personal equity funds, and financial backing funds, which allow them to grow their riches.

Check out on for details regarding the most current certified investor alterations. Financial institutions generally fund the bulk, but hardly ever all, of the funding called for of any purchase.

There are mostly 2 rules that allow providers of safety and securities to use unrestricted quantities of safety and securities to capitalists. accredited investor network. One of them is Rule 506(b) of Policy D, which allows a company to sell securities to unlimited recognized capitalists and up to 35 Sophisticated Investors only if the offering is NOT made via general solicitation and general marketing

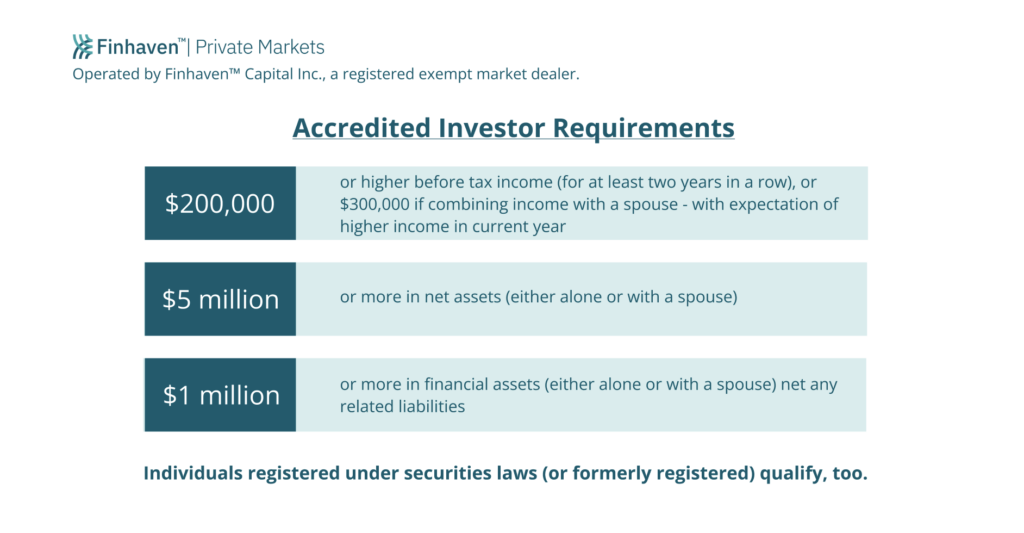

The newly embraced amendments for the very first time accredit private capitalists based on monetary sophistication requirements. The modifications to the recognized capitalist interpretation in Guideline 501(a): consist of as recognized investors any kind of depend on, with complete possessions a lot more than $5 million, not created particularly to acquire the subject safety and securities, whose acquisition is directed by a sophisticated individual, or include as certified financiers any entity in which all the equity proprietors are recognized investors.

There are a number of registration exceptions that eventually increase the universe of prospective investors. Numerous exemptions call for that the financial investment offering be made just to individuals who are approved capitalists (accredited investor verification).

In addition, recognized financiers commonly get extra positive terms and higher potential returns than what is readily available to the public. This is because personal placements and hedge funds are not required to abide by the exact same governing requirements as public offerings, permitting for more flexibility in terms of investment approaches and prospective returns.

Definition Of Qualified Investor

One factor these security offerings are limited to recognized financiers is to make sure that all getting involved investors are economically advanced and able to fend for themselves or sustain the danger of loss, hence providing unnecessary the protections that come from a registered offering.

The net worth test is reasonably easy. Either you have a million bucks, or you don't. On the earnings examination, the person has to satisfy the limits for the 3 years regularly either alone or with a spouse, and can not, for instance, please one year based on private income and the following 2 years based on joint income with a spouse.

Latest Posts

Back Taxes Land For Sale

Tax Liens Investing

Surplus Funds Forms